stock market had been too high (November 2, 1929, p. XX) wrote in the New York Evening Post (25 October 1929) that “The extraordinary speculation on Wall Street in past months has driven up the rate of interest to an unprecedented level.” And the Economist when stock prices reached their low for the year repeated the theme that the U.S. Thus, immediately upon learning of the crash of October 24 John Maynard Keynes (Moggridge, 1981, p. Laying the blame for the “boom” on speculators was common in 1929. The crash helped bring on the depression of the thirties and the depression helped to extend the period of low stock prices, thus “proving” to many that the prices had been too high. After the utilities decreased in price, margin buyers had to sell and there was then panic selling of all stocks. In October 1929, the bad news arrived and utility stocks fell dramatically.

This sector was vulnerable to the arrival of bad news regarding utility regulation.

These factors seem to have set the stage for the triggering event. Public utilities, utility holding companies, and investment trusts were all highly levered using large amounts of debt and preferred stock. A second probable cause was the great expansion of investment trusts, public utility holding companies, and the amount of margin buying, all of which fueled the purchase of public utility stocks, and drove up their prices. It argues that one of the primary causes was the attempt by important people and the media to stop market speculators. While no consensus exists about its precise causes, the article will critique some arguments and support a preferred set of conclusions. This article examines the causes of the 1929 stock market crash.

#Stock crack of 1929 series#

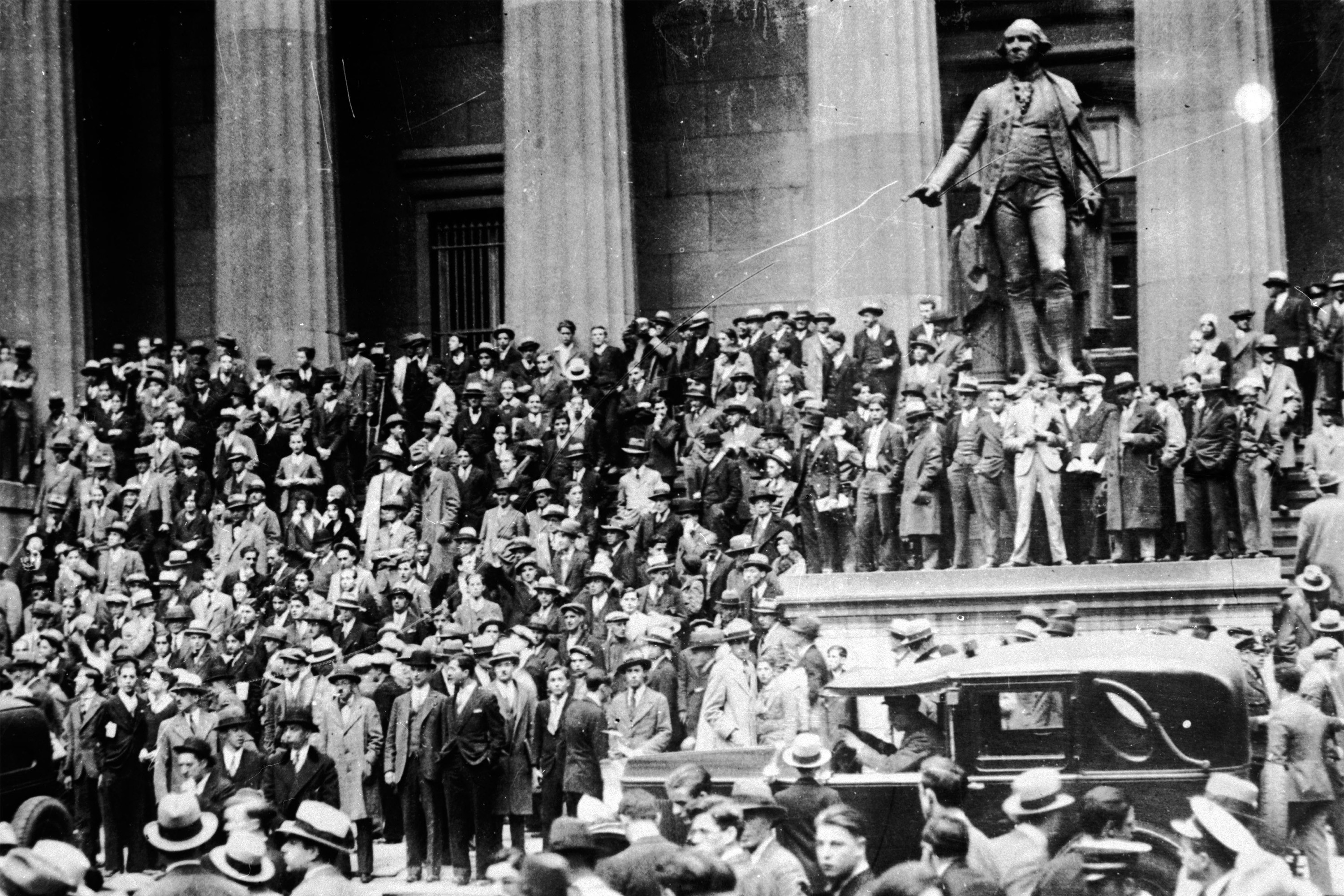

The events of Black Thursday are normally defined to be the start of the stock market crash of 1929-1932, but the series of events leading to the crash started before that date. By the time the crash was completed in 1932, following an unprecedentedly large economic depression, stocks had lost nearly 90 percent of their value. By November 13, 1929, the market had fallen to 199. By all accounts, there was a selling panic. On this day the market fell 33 points - a drop of 9 percent - on trading that was approximately three times the normal daily volume for the first nine months of the year. At the end of the market day on Thursday, October 24, the market was at 299.5 - a 21 percent decline from the high. On September 3, 1929, the Dow Jones Industrial Average reached a record high of 381.2. These two dates have been dubbed “Black Thursday” and “Black Tuesday,” respectively. The 1929 stock market crash is conventionally said to have occurred on Thursday the 24 th and Tuesday the 29 th of October. "Darwin's theory that man can adapt himself to almost any new environment is being illustrated, in this day of economic change (…) Occupations and duties which once were scorned have suddenly attained unprecedented popularity.Harold Bierman, Jr., Cornell University Overview Davis, Secretary of Labor, September 12, 1930 “We have hit bottom and are on the upswing.” Harvard Economic Society, a few days after the 1929 crash. We are not facing a protracted liquidation.” “A severe depression such as 1920-1921 is outside the range of probability. “Stock collapse (…) but rally at close cheers brokers Bankers optimistic, to continue aid.” ".fundamental conditions of the country are sound, my son and I have for some days been purchasing sound common stocks.” Two weeks before the crash of Black Tuesday, on October 29, 1929. Irving Fisher, economist and professor at Yale University, “In a few months, I expect to see the stock market much higher than today.” The high tide of prosperity will continue”Īndrew W.

0 kommentar(er)

0 kommentar(er)