- Network inventory advisor 3.9 keygen mac os x#

- Network inventory advisor 3.9 keygen software#

- Network inventory advisor 3.9 keygen Pc#

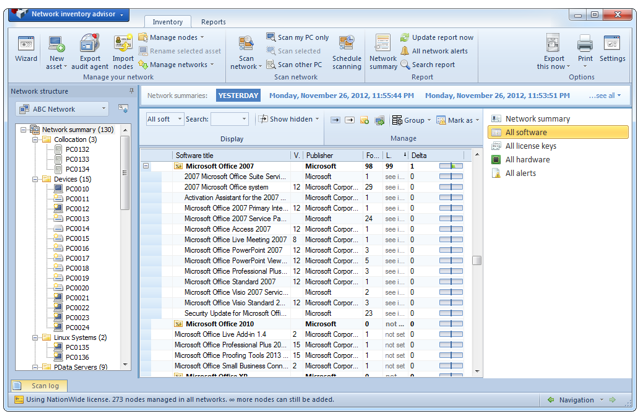

Network Inventory Advisor also discovers and tracks all hardware in your network.

Network inventory advisor 3.9 keygen software#

This means that whenever there's a software change on a node, you get automatically notified with the special alert. The latest version of Network Inventory Advisor introduces automatic You can also specify software usage status (allowed, prohibited, must-have, etc), add notes to any software title (for reminding, licensing or other purposes), sort and filter them by multiple parameters, and build flexible report. With Network Inventory Advisor it's possible to group inventoried software titles by publisher, version, software type, etc.

Network inventory advisor 3.9 keygen mac os x#

It excellently performs scanning of Windows, Mac OS X and Linux and provides IT managers with rich functionality for an easy software licenses audit.

Network inventory advisor 3.9 keygen Pc#

Network Inventory Advisor is an agent-free utility which brings you fast and reliable PC network inventory. License: Shareware, $89 to buy Size: 12255 KB It excellently performs remote agentless scanning of Windows, Mac OS X and Linux and builds custom inventory reports. But if those proposed tax changes stall out - as have many of President Trump's other proposals - Cisco's business could stagnate.Network Inventory Advisor is an agent-free solution for PC network inventory. If that happens, Cisco could spend that cash on domestic acquisitions, buybacks, and dividends - which could lift the stock. Many Cisco bulls believe that the Trump Administration and the Republican-controlled Congress will lower that tax rate and enable companies to repatriate their overseas cash. Cisco keeps the rest overseas to avoid getting hit by the U.S. Unfortunately, just $3 billion of that total is actually in the U.S. The bulls often note that Cisco finished last quarter with $70.5 billion in cash and equivalents, so it could buy more companies to boost its top line growth again. As Cisco's ability to bundle hardware and software together weakens, higher-growth businesses like security software could suffer. That slowdown is likely associated with its loss of market shares in networking hardware. Revenue growth of Cisco's security business. However, the growth of that business has been slowing down in recent quarters: It was built atop about a dozen acquisitions since 2000, and generated $2.2 billion in revenues last year. The slowing growth of its security businessĬisco's security business, which adds cybersecurity solutions to its hardware and software bundles, is traditionally one of its fastest-growing businesses.

All those figures indicate that customers are shopping around for better deals and cutting Cisco out of the loop. HPE (which reported its results with H3C a year earlier) also saw its share of switches rise sequentially from 5% to 6%. Meanwhile, Arista's share of the switching market rose from 3.9% to 5.1%.

Juniper's market share in switches rose from 3.2% to 4.3%, and its SP and enterprise router market share grew from 14.5% to 15.6%.

Its combined service provider (SP) and enterprise router market share fell from 48.8% to 43.9%.ĭuring that period, Huawei's share of the switching market rose from 3.9% to 6.3%, while its share in SP and enterprise routers rose from 16.3% to 19.8%. Both units posted 9% annual revenue declines, due to tough competition from challengers like Arista, Huawei, Hewlett-Packard Enterprise ( HPE -0.97%), and Juniper Networks ( JNPR -0.46%).īetween the first quarters of 20, Cisco's global share of the ethernet switching market fell from 59% to 55.1%, according to IDC. Its ongoing market share lossesĬisco still generated almost half its revenue from sales of routers and switches last quarter. Cisco is trying to slow down Arista with lawsuits, but it isn't doing much damage - analysts still expect Arista's revenue to soar 41% this year. Its hardware runs on an open-source Linux-based OS, and its FlexRoute software aims to replace traditional routers with software-based solutions. The biggest threat in this market of SDN (software-defined networking) solutions is Arista Networks ( ANET 0.02%), which sells cheaper multilayer network switches for white box networks. Facebook has also been installing white box hardware in its data centers. Earlier this year, AT&T tested out a high-speed network running on white box hardware, including hardware from different vendors running on different chips. Many customers believed that they had to buy all their networking hardware and software from a single vendor, like Cisco, for everything to run smoothly.īut in recent years, a growing number of companies started installing generic " white box" hardware running on open source software to cut costs. The rise of "white box" networksįor decades, Cisco's business depended on enterprise customers buying bundles of its networking hardware and software solutions.

0 kommentar(er)

0 kommentar(er)